Very dynamic Q3 driven by Believe’s attractivity to artists and labels demonstrating Believe’s strong digital platform model

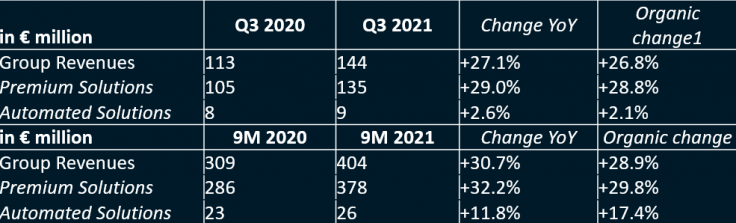

Revenue growth: +27% in Q3, +31% year-to-date

Organic revenue growth: +27% in Q3, +29% year-to-date

Digital sales growth: +30% in Q3, +33% in year-to-date

FY 2021 guidance uplifted with organic growth now anticipated at least at +27%

Paris, November 3, 2021 – Believe (Ticker: BLV, ISIN: FR0014003FE9), one of the world’s leading global digital music companies, published today its revenue for the third quarter of 2021.

Denis Ladegaillerie, founder and CEO, said: “We are investing in people and technology to build the best development platform for artists in the digital music era. Our strong revenue growth in Q3 reflects significant market share gains driven by the revenue ramp-up of the investments we have made in the past 24 months. These gains once again demonstrate Believe’s attractivity to artists and labels at all stages of their career thanks to our digital DNA and digital marketing expertise. Our digital-first approach was key to successfully signing our staged acquisition in Play Two, the largest independent label in France. We also signed two partnerships in alignment with our objective to shape music for good.”

Key highlights

Q3 robust performance was driven by the unparalleled attractivity of Believe for artists and labelslooking for digital solutions and expertise, at each stage of their development. For another quarter, digital sales outperformed the market as recent investment in local sales and marketing teams resulted in a record level of signings in the concerned countries. Believe has been able to deliver top quality services for all its artists and labels, at scale thanks to its unique model based on a central data-driven, scalable technology platform and strong local presence.

Aligned with its growth strategy based on increased investment in local sales and marketing, Believe reinforced its local management team in Russia and Eastern Europe adding key skills in digital and streaming services to prepare for the next phase of growth in a context of booming market trends. Russia and Eastern Europe have long been a high priority for the Group which was the first international music company to establish a local presence back in 2013.

The M&A transaction announced today is another illustration of the Group’s proven attractivity for independent labels, which see the benefits of the Group’s digital expertise to grow audiences of their artists. Believe entered in a strategic partnership with Play Two, a highly reputed and the 1 st independent label in France and acquired 25% of the company, which is majority held by Group TF1, the French leading TV Group. This transaction underlines the Group’s M&A strategy, presented at the time of the IPO, which aims at reinforcing its footprint in key countries to accelerate revenue growth. The transaction is also allowing Believe to position on more diversified music genres such as pop for example, which are not yet fully digitized to benefit from the ramp up of their digital revenues.

Believe continued to strengthen its attractivity by accelerating digital innovation and developing best-inclass technology solutions. Believe continued to invest and innovate in building a suite of data-based and marketing automation solutions to support artists’ by helping them build efficient go-to-market strategies. In Q3, Believe strengthened its market differentiation by its investment in a SaaS media buying automation platform, a future-proof marketing solution to develop and engage audiences of artists and labels by automatically building and executing targeted media-buy marketing campaign. The Group has enriched an advertising platform and tailored it for the music industry to offer a unique multi-local solution from emerging to top artists and labels. The Group has deployed the solution in 12 countries so far. Believe also in-house developed an algorithmic technology which aims at predicting the virality of a track on TikTok. The algorithm classifies recommended tracks on various categories (emerging, rising, booming, top hits and sunsetters), which Believe can then use to alert its artists and labels to existing and emerging opportunities and implement digital strategies at the optimum time in order to grow their audience.

Overall, Believe further benefitted from the positive structural market trends combining acceleration of paid streaming penetration and diversifying monetization sources for music. The Group also took advantage of its solid market share in several fast-growing emerging markets (Turkey, China, India, Russia, Eastern Europe, Mexico, Brazil, …). Believe has been regularly the first international music companies to establish strong local presence in these markets.

Believe continued to deploy its CSR strategy as a core objective to shape the music industry for the better. Believe also demonstrated during the quarter its commitment to shape the music for good by signing two key partnerships to promote parity in the music industry and to offer women greater access to tech companies. This includes a partnership with Key Change (global network working to reach full gender equality in the music industry) and a partnership with 50inTech (for a 50% representation of women in tech). This is fully aligned with its CSR pillar - Developing diverse and local talent in local markets first - which aims in priority at promoting gender equality in the music industry and positions Believe as an exemplary inclusive and responsible actor in the sector.

Revenues

Q3 2021 revenues grew by +27.1% to reach €144 million (versus €113 million in Q3 2020) mainly reflecting strong organic growth (+26.8%), with digital sales up +30.4%. Overall, the Group continued benefitting from the favourable structural trends in the digital music industry and from its positioning on the fastest growing markets strengthened by investment in localsales and marketing over the past 24 months. Revenue growth was mostly driven by gain of new artists and labels, expansion of services offering in key markets and by the roster’s performance.

Revenue growth in Q3 was stronger than anticipated due to market share gains above initial expectations in several key regions (Asia, Latin America and Europe). In addition, several emerging markets remained on fast-growth aligned with Q2 trends, which were supported by the recovery in ad-funded streaming services particularly affected by the Covid-19 pandemic in Q2 2020. Moreover, physical sales were slightly down during the quarter, while the Group expected a more pronounced decrease in line with the ongoing curtailing of physical heavy commercial contracts. As a result, revenues were up 30.7% year-over-year for the first nine months of 2021 reaching €404 million with digital sales up +32.6%, reflecting an organic growth of +28.9%.

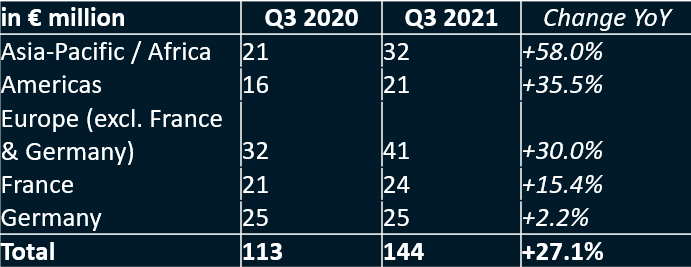

Revenues by geography: growth in all geographies

In Q3, revenues in Asia Pacific and Africa grew strongly at +58.0% compared to last year and represented 22.6% of group revenues. Market dynamics were strong across the various regions. In this context of booming market growth, Believe gained significant share during the quarter thanks to the roll-out and strengthening of premium services in several countries in the region in 2020 and early 2021.

Americas grew by +35.5% and represented 14.7% of total revenues, resulting from strong activity level in Latin America thanks to solid investment in local sales and marketing.

Europe (excluding France and Germany) reported revenue growth of +30.0% and represented 28.4% of total revenues in Q3, including a small positive perimeter impact related to DMC label in Turkey (consolidated in August 2020). The level of activity remained very dynamic in the region during the quarter and particularly in Russia, where Believe leveraged its early penetration in the fast-developing music market and in Turkey, where the Group reinforced its local footprint last year.

In France, revenues increased by +15.4% in Q3, driven by the strong performance of artist services activities and further growth in artist and label solutions which resulted into significant digital sales increase above market growth. The decrease in physical sales, however, weighed on the overall performance.

In Germany, revenues grew by +2.2% as they were still affected by ongoing reorganization of the activities to optimize digital solutions and reduce exposure to physical sales. France and Germany respectively represented 16.8% and 17.5% of group revenues over the quarter.

Revenues by segment

In terms of segment, Premium Solutions revenues amounted to €135 million in Q3 2021, a year-over-year organic increase of +28.8% versus Q3 2020. Premium Solutions continued building up its position in key markets thanks to investment in local sales and marketing and by expanding the range of services offering in several countries. In addition, the Group leveraged its early move in emerging markets which are now fully benefiting from new digital listening trend. Overall, market growth remained strong notwithstanding a less favorable comparison basis as add-funded streaming services started recovering in Q3 2020.

Automated Solutions amounted to €9 million and grew by +2.6% in Q3 2021 compared to last year, mostly reflecting an organic growth of +2.1%. Q3 growth rate experienced headwinds compared to the prior year, as Automated Solutions grew strongly in H2 2020. The extension of lockdowns resulted in an unprecedented boom in new customers with an elevated rate of distribution in Q3 and Q4 2020, which did not continue with the reopening of the economies.

FY 2021 outlook and organic growth guidance update

Digital services activities recorded strong revenue growth in Q3 and are expected to pursue this trajectory as a result of structural market trends and Group’s focus on investing in local sales and marketing to consolidate its global position. Physical sales which recorded a slight decrease in Q3 are expected to decrease in the last quarter. The trend has, however, improved and the decrease will have a more limited impact on total revenues than anticipated by the Group beginning September. In this context, Believe now anticipates an annual organic growth of at least +27% in 2021 (compared to previous forecast of organic growth of at least +23%). The recent transaction regarding Play Two, the 1st independent label in France, will have a limited impact on 2021 revenues with the integration agreement slowly ramping up.

As a result of higher organic growth expectations, the Group is now anticipating an adjusted EBITDA margin above 3% for 2021, a steep increase compared to last year level which amounted to 1.7% (compared to previous indication “slightly above FY2020 level”). Believe will continue to substantially invest in its commercial and marketing development and central platform to support the strong growth of its businesses and therefore margin expansion will remain limited.

(1)Organic change accounts for revenue growth at a like-for-like perimeter and at constant exchange rate. The change in perimeter only concerned Premium Solutions in Q3 2021, no perimeter impact in Automated Solutions.

About Believe

Believe is one of the world’s leading digital music companies. Believe’s mission is to develop independent artists and labels in the digital world by providing them the solutions they need to grow their audience at each stage of their career and development. Believe’s passionate team of digital music experts around the world leverages the Group’s global technology platform to advise artists and labels, distribute and promote their music. Its 1,401 employees in more than 50 countries aim to support independent artists and labels with a unique digital expertise, respect, fairness and transparency. Believe offers its various solutions through a portfolio of brands including TuneCore, Nuclear Blast, Naïve, Groove Attack and AllPoints. Believe is listed on compartment A of the regulated market of Euronext Paris (Ticker: BLV, ISIN: FR0014003FE9). www.believe.com

Forward Looking statement

This press release contains forward-looking statements regarding the prospects and growth strategies of Believe and its subsidiaries (the “Group”). These statements include statements relating to the Group’s intentions, strategies, growth prospects, and trends in its results of operations, financial situation and liquidity. Although such statements are based on data, assumptions and estimates that the Group considers reasonable, they are subject to numerous risks and uncertainties and actual results could differ from those anticipated in such statements due to a variety of factors, including those discussed in the Group’s filings with the French Autorité des Marchés Financiers (AMF) which are available on the website of Believe (www.believe.com). Prospective information contained in this press release is given only as of the date hereof. Other than as required by law, the Group expressly disclaims any obligation to update its forward-looking statements in light of new information or future developments.

Some of the financial information contained in this press release is not IFRS (International Financial Reporting Standards) accounting measures.