Successful initial public offering of Believe on Euronext Paris

- Capital raise amounting to approximately 300 million euros, and up to approximately 330 million euros in case of full exercise of the over-allotment option

- Offer price set at 19.50 euros per share, implying a market capitalization of approximately 1.9 billion euros before exercise of the over-allotment option

- Strong demand from well-established investors, in France and abroad as well as the French public offering

- Believe shares will start trading on the regulated market of Euronext Paris, compartment A, on June 10, 2021 on a when-issued basis (“promesses d’actions”)

Paris, June 9, 2021 - Believe, one of the world’s leading digital music companies, announces today the success of its Initial Public Offering (IPO) in view of the admission of its shares to trading on the regulated market of Euronext Paris (Compartment A, ISIN code FR0014003FE9, ticker symbol BLV).

The Offering has been a strong success with leading French and international institutional investors. Based on the offering price of 19.5 euros per share, the market capitalization of Believe would amount to 1.9 billion euros (before exercise of the over-allotment option).

Denis Ladegaillerie, Founder and CEO of Believe, said: "Believe is crossing a new threshold in its development by going public. The funds raised will allow us to invest in our innovative technology platform and to implement our ambitious strategy of targeted acquisitions. This transaction was also intended to build a solid and balanced shareholder base alongside TCV, our long-term shareholder. We are delighted to welcome the Fonds Stratégique de Participations (FSP), a long-term investor that supports the development of French champions, and Sycomore Asset Management, a leading player in responsible investment. This listing gives us the means to accelerate our development by fulfilling our mission to develop independent artists and labels in the digital world with respect, fairness and transparency.”

Denis Ladegaillerie, Founder and CEO of Believe, added: "I would like to thank our great teams, all of whom showed a great commitment in preparing our IPO and fulfilling our mission to serve artists and independent labels. I would also like to thank our historical shareholders, Ventech, XAnge, GP Bullhound and Thierry de Passemar, who have been by our side for many years and have fully played their role as committed shareholders in the first phase of our development. Alongside TCV and the management team, their contributions have been essential to the development of Believe to date.”

Rationale of the Offering

Believe’s initial public offering mainly aims to support the Group’s development and growth strategy focused on (i) the continuation of the Group's international expansion, (ii) the continuation of a targeted external growth strategy and (iii) the improvement and extension of existing capabilities through investments in its technology platform. The Group intends notably to allocate the proceeds of the new shares issuance towards financing the investments until 2023 identified in its 2022-2025 development plan.

The Company also intends to refinance its existing indebtedness in the context of the IPO. Approximately €90 million of the proceeds of the new shares issuance will therefore be allocated to the repayment of all amounts due under the Company’s existing Credit Agreement. This repayment will be made together with the implementation of a new revolving credit facility in an amount of €170 million, entered into on 6 May 2021 with a syndicate of international banks, which gives the Group additional means of financing its development and growth strategy.

Final terms of the Offering:

Price of the Offering

The price of the Offering is set at 19.50 euros per share.

This price implies a market capitalization of Believe of approximately 1.9 billion euros, before exercise of the overallotment option.

Allocation of the Offering

As part of the initial Offering, 15,384,616 New Shares have been allotted, of which

- 1,109,574 New Shares in the French Public Offering, representing 7.2% of the initial size of the Offering

- 14,275,042 New Shares in the International Offering, representing 92.8% of the initial size of the Offering

Size of the Offering

The gross proceeds of the issuance of 15,384,616 New Shares amount to approximately €300 million and may be increased to a maximum of approximately €330 million, should the over-allotment option be exercised in full.

The amount of the net proceeds of the issuance of the New Shares is estimated at approximately €280 million (€309 million in case of full exercise of the over-allotment option).

Over-allotment option

The over-allotment option relates to the issuance of new ordinary shares, representing a maximum of 10% of the number of New Shares, corresponding to a maximum of 1,538,461 Additional New Shares, which would increase the size of the Offering to 330 million euros. The over-allotment option can be exercised by J.P. Morgan AG, as Stabilization Agent and on behalf of all the underwriters of the transaction. The over-allotment option may be exercised by the Stabilization Agent until July 9, 2021, the end of the stabilization period.

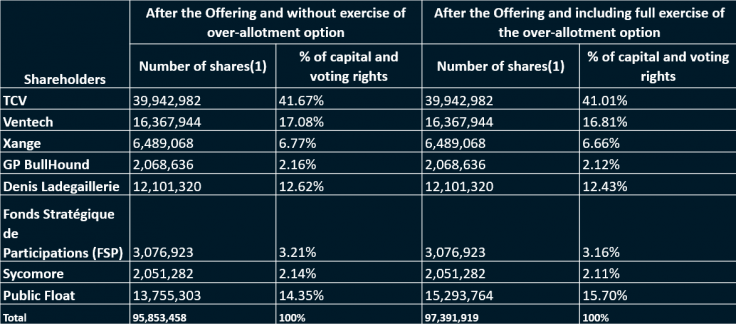

Change in the shareholding structure

Upon completion of the offering, Believe’s shareholding structure will be as follows:

(1) Number of shares in the Company’s share capital after taking into account the share capital reorganization and new shares issued as part of the Offering

(2)Number of shares in the Company’s share capital after taking into account the share capital reorganization and new shares and Additional new shares issued as part of the Offering

The Fonds Stratégique de Participations (FSP), who had committed to the Company to place an order for shares in an amount of €60 million as part of the International Offering, was allotted 3,076,923 shares.

Free Float

Free float will represent approximately approximately 14.35% of Believe’s share capital post-Offering, and could increase to approximately 15.70% of Believe’s share capital in case of full exercise of the over-allotment option.

Lock-up agreements

Believe has committed to a lock-up of 180 calendar days following the settlement date of the Offering, subject to certain customary exceptions.

TCV, Ventech, XAnge and GP Bullhound have committed to a lock-up of 180 calendar days following the settlement date of the Offering, subject to certain customary exceptions.

Denis Ladegaillerie has committed to a lock-up of 365 calendar days following the settlement date of the Offering, subject to certain customary exceptions. In addition, Mr Ladegaillerie has committed to a 3-year lock-up pursuant to the shareholders’ agreement entered into with TCV, Ventech and XAnge in the context of the IPO, subject to certain exceptions and conditions.

The Fonds Stratégique de Participations (FSP) has committed to a lock-up of 180 calendar days following the settlement date of the Offering, subject to certain customary exceptions.

Holders of warrants for shares (“BSA”) and warrants for subscription to business creator shares (“BSPCE”) within the Group (including certain managers and executives of the Group) have committed to a lock-up of 90 calendar days following the settlement date of the Offering for the new ordinary shares that would be allocated to them should their BSA and BSPCE be exercised. This period will be 365 calendar days (i) for all managers and executives of the Group, for all new ordinary shares that would be allocated to them as part of the exercise of the BSA and BSPCE they hold in respect of the 2018 and 2019 plans and (ii) for all holders of BSA and BSPCE within the Group in respect of the 2018 and 2019 plans, for the BSA and BSPCE that would not yet be exercisable as of the settlement date of the Offering.

Timetable of the Offer

The trading of Believe shares on a when-issued basis on the trading line “Believe Promesses” will start on June 10, 2021 at 9:00 a.m. (Paris time) on the regulated market of Euronext Paris.

Settlement and delivery for the shares issued in the Offering is expected to occur on June 11, 2021.

From June 14, 2021, the Believe shares will start trading on the trading line « Believe » on the regulated market of Euronext Paris.

The over-allotment option may be exercised by the Stabilization Agent until July 9, 2021, the end of the stabilization period.

Financial intermediaries

Citi, J.P. Morgan and Société Générale are acting as Joint Global Coordinators and Joint Bookrunners. BNP Paribas, Goldman Sachs, HSBC and UBS are acting as Joint Bookrunners. Rothschild & Co is acting an independent financial advisor to Believe.

Publicly available information

Copies of the French prospectus that has been approved by the AMF on May 31st, 2021 under the number 21-191, consisting of a registration document (document d’enregistrement) approved on May 7th, 2021 under the number I.21-018, a supplement to the registration document (supplement au document d’enregistrement) approved on May 31st, 2021 under the number I.21-026, a securities note and a summary of the French prospectus (included in the securities note), are available free of charge upon request to the company at Believe, 24 rue Toulouse Lautrec, 75017 Paris, France, as well as on the website of the AMF (www.amf-france.org) and on the company’s website dedicated to its IPO process (investors.believe.com).

The Group draws attention to the risk factors contained in Chapter 3 of the registration document and in Section 2 of the securities note. The occurrence of one or more of these risks may have a material adverse effect on the business, reputation, financial condition, results of operations or prospects of the Group, as well as on the market price of Believe’s shares.

About Believe – Believe is one of the world’s leading digital music company. Believe’s mission is to develop independent artists and labels in the digital world. We accomplish our mission by providing them the solutions they need to grow their audience at each stage of their career and development. Believe’s passionate team of digital music experts around the world leverages the Group’s global technology platform to advise artists and labels, distribute and promote their music. Our 1,270 employees in more than 50 countries aim to support independent artists and labels with a unique digital expertise, respect, fairness and transparency. Believe offers its various solutions through a portfolio of brands including TuneCore, Believe, Nuclear Blast, Naïve, Groove Attack and AllPoints.