5 things to know about Japanese music market with Erika Ogawa

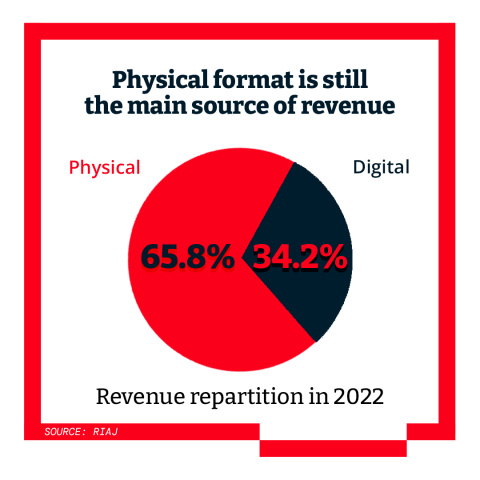

With a market value of over $2 billion in 20221, Japan is the second largest music market in the world2, a rank the country has held for over ten years. One might have expected this country, long celebrated for its high-tech, to be a pioneer of digital music. And yet, the Recording Industry Association of Japan reports that physical formats still accounted for 66% of all music sales in 2022.

Despite Japan's internet penetration rate reaching 82.9% in 2022 and 95.3% of its 125 million population owning smartphones3, CDs remain the preferred format among music consumers. In 2022, CDs contributed over 129.8 billion yen to the Japanese music industry.

Music streaming may have taken a while to catch on, but it's now firmly established: in 2022, streaming music revenues grew by 25%, while digital music revenues "exceeded 100 billion yen for the first time since statistics began in 2005" according to the RIAJ1.

To shed light on the Japanese music market, from its digital transformation to the influence of fandoms on the CD market, we caught up with Erika Ogawa, recently appointed General Manager of Believe Japan.

Although this has been changing in recent years, Japan remains a country where physical records - particularly CDs - are still very important. Is this a legacy of the last decades of the 20th century? And how has it shaped the Japanese music industry today?

Several factors explain why the CD format has thrived in Japan more than in similar markets like the USA, UK, or France.

I would first say there’s a strong cultural component: Japanese people have a strong attachment to objects linked to their passion, which is why the market still offers a lot of collectable CDs for fandom, for instance. Speaking of fandoms, it's not uncommon for fans to buy the same CD of their favorite artist several times to support them. Fandoms also lead fans to purchase numerous CDs when labels include "golden tickets," granting access to face-to-face meetings with idols. An anecdotal legend even claims that 80% of CDs put on the market remain unopened.

The age demographic also plays a crucial role; about 29% of Japan's population is over sixty-five, and this segment tends to prefer physical formats over digital ones. It's not a surprise, older markets take more time to convert.

Finally, the Japanese music industry's relatively conservative nature further slowed the adoption of music streaming. When foreign players wanted to impose their model without considering cultural differences and the local ways, this created mistrust towards digital music business models.

According to the Recording Industry Association of Japan1, streaming was representing 88.4% of digital music revenue share in 2022, but only 54.1% in 2018. How do we explain such a change in only four years? And who benefits from this change?

The change wasn’t sudden. It has been very slow then accelerating, but the acceleration was about the same as in other markets. Once you reach 4 to 5% of the overall population paying for music, there’s an acceleration of digital music penetration and paid subscriber growth.

Given the importance of the physical format in Japan, you might have thought that the growth of the streaming market would be slower than in other, more streaming-friendly markets. The reality is that it hasn't: the local streaming market has grown exactly as planned. It should have started earlier, if it was not for roadblocks such as the conservativeness of the local music industry and the aging population, but once some of these roadblocks were removed, the local market eventually aligned with global trends.

Currently, prominent local DSPs include LINE MUSIC and Recochoku, alongside international giants like Apple Music, Spotify, and Amazon Music. YouTube is present of course, and is one of the most rapidly growing DSPS, even still we feel it's under-utilized by the music industry. It has untapped potential, particularly in terms of monetization, audience engagement and artist development which should be exploited by leveraging all its capabilities.

There have been many transitions since streaming companies arrived in Japan. But I'd say it's local musicians and artists who have benefited most. Companies like TuneCore Japan have attracted many users who recognize the potential to connect with global audiences through these platforms. It has been a major evolution for Japanese independent creators, who took advantage of this faster than the rest of the local music industry.

From what I saw in the past 10 years, I would say that labels didn’t always leverage streaming and digital marketing enough. They have been very slow in bringing their catalogs on streaming services. It's common knowledge that a large chunk of content, especially legacy content from the 50s, 60s and 70s, is still not available on platforms because of copyright clearing issues.

Back when contracts were originally inked, they understandably pertained only to the physical format, not the digital one. But Japanese labels hold a deep respect for artists and are averse to placing content online without explicit consent. Interestingly, even when companies possess digital distribution rights, they come back for consent. This perfectly illustrates how Japan, and by extension the local music industry, is guided by courtesy and traditional customs. If you come from abroad, you can't succeed if you don't understand this.

For a positive change to the market, two key strategies stand out. Firstly, it's crucial for artists and the music industry to gain broader access to diverse and advanced insights from the international market and to enhance their understanding of it. This would open a variety of ways to develop artists’ career.

Secondly, labels’ top management should proactively allocate more resources to digital and appoint the right upcoming leaders who can skillfully navigate the digital landscape. It involves optimizing digital marketing investment and editorial marketing strategies, while improving their understanding of algorithm-based recommendations and YouTube monetization. When they see that digital is under-exploited and can bring in more revenue, they will likely channel more resources and focus on digitizing content.

There have been many transitions since streaming companies arrived in Japan. But I'd say it's local musicians and artists who have benefited most [...] users who recognize the potential to connect with global audiences through these platforms. It has been a major evolution for Japanese independent creators.

What does the Japanese musical landscape look like, and what do the Japanese people listen to? From an outsider's point of view, it seems that local music isn't exported much, but to what extent is this true?

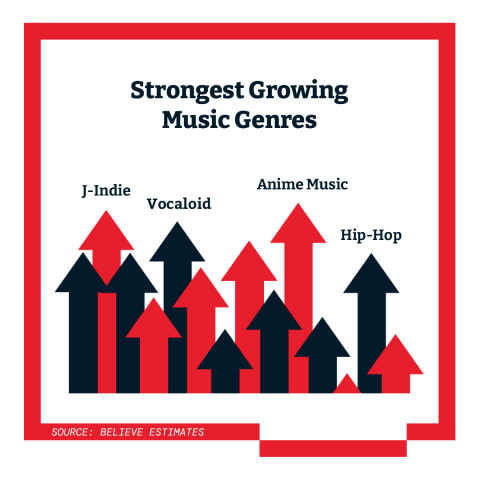

Well, J-Pop is what people listen to the most, but J-Pop covers different music sub-genres, such as J-Idol, J-Rock or Vocaloid. We’re still trying to figure out what sub-genre is growing the most in this segment. We have seen hip-hop growing significantly over the past three years, and even though it is still small, we can definitely say it’s the 3rd most streamed genre.

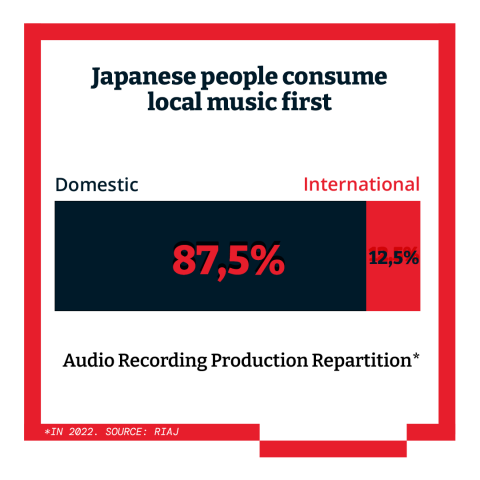

Music consumption in Japan is very domestic. This may vary from year to year, but it's usually around 90% domestic versus 10% international on physical sales. It was 88% vs 12% in 20221. Our analysis shows that the ratio is very similar on digital.

We do believe that Japanese music is under-represented internationally and doesn’t export as much as it could. Japanese culture is hugely popular across the world through animation, fashion, food, video games, but Japanese music companies are not leveraging the full benefit of this. Our meetings with Japanese labels reveal a strong interest in expanding their international reach, and they expect we can facilitate their global growth as a foreign company.

Anime music is an exception: the genre is increasingly exporting, as anime is extremely popular around the world, to the point that it's strongly supported by Japanese government. There has been a lot of business in this genre lately, and there are a lot of potential partners, including artists recognized as anime song singers. We have to be creative and strategic about how we export them, but the good thing is that their songs are known wherever the anime market exists.

You previously mentioned fandom as partial explanation for CD sales. What is the real importance of fandom in Japanese musical culture, and how is it evolving with digital and music streaming?

I think we have been very strong fandom builders, even prior to K-Pop. There was an article in TIME magazine “For the Love of K-Pop” special edition about how the local industry studied what international markets were doing, in particular Japan with its fandoms and idol systems, to develop this genre.

In recent years, we have seen the rise in Japanese society of “Oshikatsu”, it means “the act of enthusiastically supporting someone”, it was even nominated one of Japan’s buzzword in 20214. For the Japanese, "Oshikatsu" serves as a means to preserve their mental well-being and seek inspiration by identifying with role models and reconnecting with their own identity. With GDP set to fall from third to fourth place in the world over the next decade, many Japanese believe their economy will become more stagnant and less competitive. But on the contrary, this uncertain socio-economic situation has given rise to a unique music, art and culture that symbolizes this era. Whether it's an artist, an idol, an anime character or a YouTuber, Japanese people like to endorse their favorites to enrich their own quality of life by buying goods, exclusive content or experiences, and live the star's life as if it were their own.

While Japan has excelled in building artist fandoms, it has been somewhat hesitant in integrating them in new digital media. Japan remains very strong in the "physical world" partly because of an intentional choice to stick with what made it so successful. Japan is one of the top countries for fine-tuning technology, once the Japanese have established a method, they master and perfect it, and demonstrate a strong commitment to keep building on what their predecessors have built. That's why Japan boasts the largest number of long-established companies in the world. The downside is that there are less opportunities for innovation, less flexibility, and new technologies are difficult to experiment with or challenge.

So, people continue to visit stores like Tower Records to have “fans experiences – buying CDs, engaging in artist discussions, and even participating in meet-and-greet sessions, activities that solely thrive within fandoms. We think there are huge opportunities for artists and labels looking for new ways to offer their music online and bring fandoms into the digital sphere, like through Editorial Marketing strategies or bespoke digital marketing.

For instance, LINE MUSIC runs a campaign urging fans to screenshot their favorite artists' music playback for rewards. This incentive encourages digital support and engagement. Despite generating controversy, it reflects the industry's fresh trial-and-error approach toward optimization. It’s a start, and I'm confident that so much more can be achieved.

Our data and forecasts indicate continuous acceleration in music streaming growth. This won’t change, but what might evolve is the mix of key players in the domestic market, as we’re seeing global players growing faster than local ones

Going back to the opening of the Japanese music market to streaming, what do you think was the catalyst? The COVID crisis, a younger population entering the scene? And what future do you see for the local streaming market?

I’m thinking of the arrival of streaming services and "digital aggregators" like TuneCore in Japan. I actually do see TuneCore Japan as one important catalyst.

International DSPs have also been working hard to try to open the market, by demonstrating the value they can bring, and of course, by connecting Japanese artists to the rest of the world, which has started to happen and really accelerated recently. As the number of local artists available on platforms increases, so does the local audience. So, the investment they started making five years ago is now paying off.

Our data and forecasts indicate continuous acceleration in music streaming growth. This won’t change, but what might evolve is the mix of key players in the domestic market, as we’re seeing global players growing faster than local ones. I also tend to think that labels and artist management companies will have more focused roles, because distributors like Believe have a big role to play in a Japanese digital market that didn't exist before. Rather than overlapping, I think the players in this ecosystem will each have a more focused role to complement each other.

Above all, I'm looking forward to seeing how the digitization of the local music industry will influence Japanese artists and music, both at home and abroad. We've seen global chart-topping Latin artists being increasingly influenced by Japanese culture and anime5, something I’m eager to see develop in the future, as it can become a real opportunity for our artists.

Previously Head of Label Services of TuneCore Japan, Erika Ogawa-Arai joined Believe in 2022 as a leader of Label & Artist Distribution. She will now ramp up the growth of Believe Japan as General Manager.

Erika has built a successful career in the entertainment & marketing industry, being the bridge for connecting markets. As a 1st hire for starting up global entertainment brand Guinness World Records in Japan, she progressively grew a team which delivered continuous double-digit growth.

Her expertise is developing and leading best-in-class business operations, marketing Japanese entertainment content and IP leveraging her intercultural skills acquired in Europe (France and Germany), the US and Japan. Erika's passion is to pursue her role as an executive and board member of organizations that create social value to bring about better changes to Japan and the world.

Sources

1. Source: Statistic Trends – RIAJ Year Book 2023

2. Source: IFPI’s Global Music Report 2023

3. Source: Digital 2023: Japan — DataReportal – Global Digital Insights

4. Source: As the pandemic drags on, more in Japan find solace in 'oshikatsu' devotion - The Japan Times

5. Source: How Japan has inspired Latin music artists from Tainy to Rosalía – Billboard